Present value of future lease payments

The lease liability is measured at the present value of the lease payments. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

How To Calculate The Present Value Of Lease Payments In Excel

What if your lease payments depend on future sales inflation use of the asset interest rate or other things - what should you do.

. But which lease payments should be included in the lease liability initially and subsequently. An example of an ordinary annuity is a series of rent or lease payments. Fixed at 20 per year.

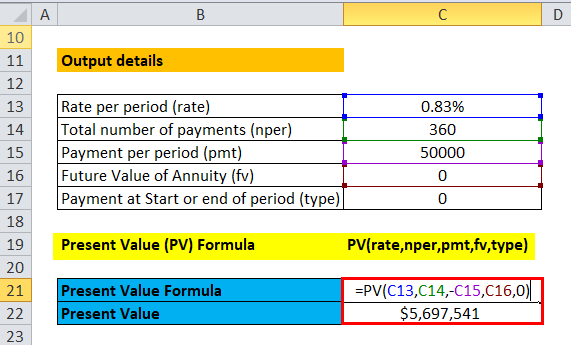

Assume that your business will receive a 10000 payment 3 years from now. The present value calculation has not changed from ASC 840 to ASC 842. Initially the company creates a Lease Asset based on the Present Value of the lease payments over the next 10 years.

Here is an overview of how the new. Contingent rents ASC 840-10-25-5. How should you account for them under IFRS 16.

So when determining the lease liability and ROU asset the future lease cash flows must undergo the present value calculation. It provides an. In this example it is 12 payments of 10000 occurring on the first day of each month starting on 2021-1-1 to 2021-12-1.

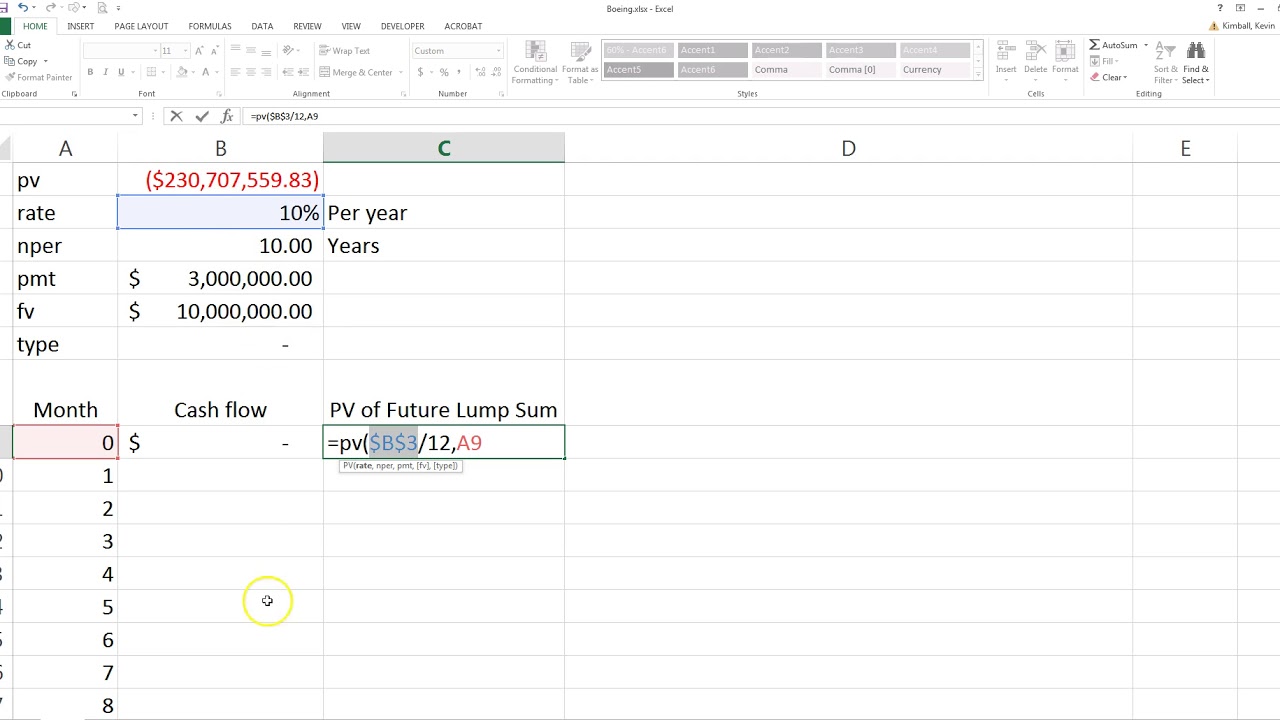

Because there is a change in the future lease payments Entity Q remeasures the lease liability to reflect the net present value of the eight remaining payments of CU5400 discounted at the original discount rate of 5. You may also need to buy insurance to guarantee that the asset will have a specified value at a future date. In terms of present value we can see how much you would cost the next five months if you kept your money in a 5 interest account.

These are the future payments related to the lease. The present value is given in actuarial notation by. The answer to this question will determine the scale of the impact of the new standard for lessees.

Once these payments are present valued it forms the lease liability. The present value calculation for an ordinary annuity is used to determine the total cost of an annuity if it were to be paid right now. How Each Standard Explains Present Value.

5 this is close to the rate the company would pay on secured debt. P PMT 1 - 1 1 rn r Where. In fact the present value is typically less than the future value.

Present value of lease payments explained. This is your right-of-use assent and the lease liability. PVGRVFV The present value PV of all the lease payments plus guaranteed residual value GRV is greater than the fair value FV of the asset being leasedYou may also see sales agreements.

Download our Present Value Calculator to determine the present value of your lease payments under ASC 842 IFRS 16 and GASB 87. It is the liquidation value of a company in bankruptcy. Insurance value This is the appraised value by an insurance company used to set the price of insurance as part of its risk assessment.

Book value Book value is the worth of the mineral interests after the project has paid off all its debts assets liabilities. A lease agreement that is partially financed by the lessor through a third-party financial institution. You will need to estimate the value of the operating lease and compute the present value of capital lease payments at the time of the conversion.

Once these payments are present valued this will be the value of the lease liability. For example you could use this formula to calculate the present value of your future rent payments as specified in your lease. However at the lease commencement the CPI increase has no bearing on future lease payments.

Our publication Lease payments PDF 17 MB will help you. As stipulated by your lease the current price of your future rental payments may be determined with this formula for instance. You assume an interest rate also called a discount rate.

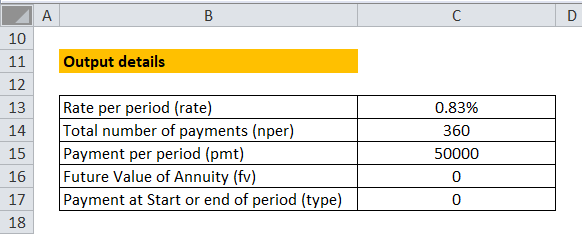

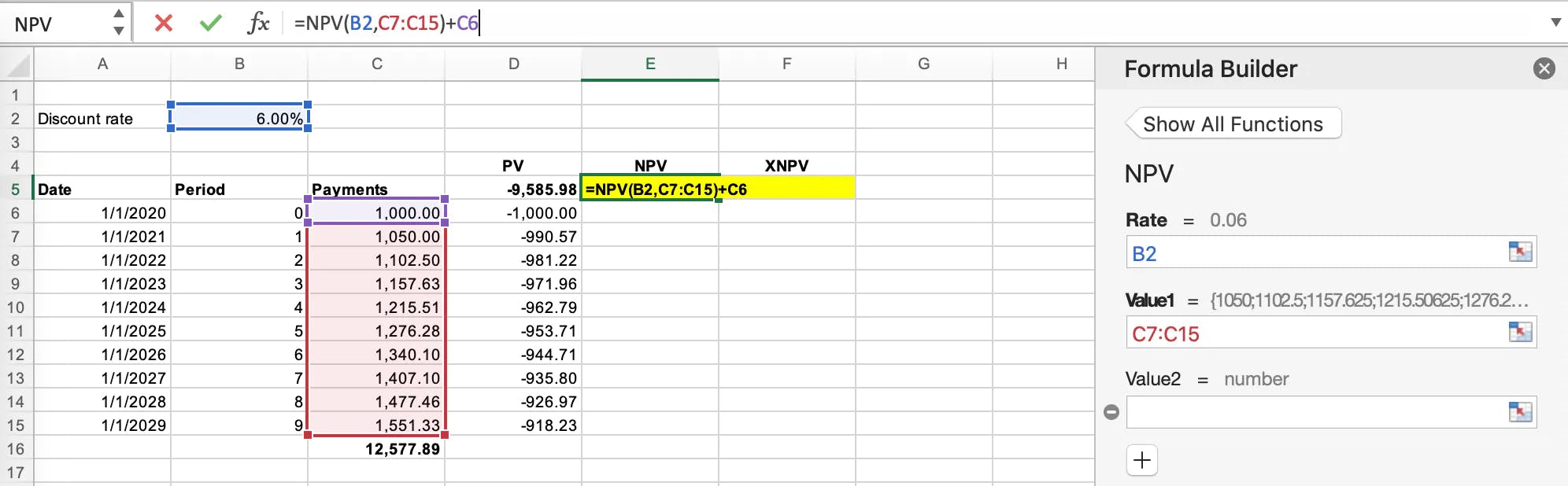

When calculating the lease liability the first step is to work out the known future payments at the start of the lease. In this example there are 12 payments of 1000 paid at the start of each month. Calculate Accurately for Compliance To comply with the new lease accounting standards youll need to calculate the present value of.

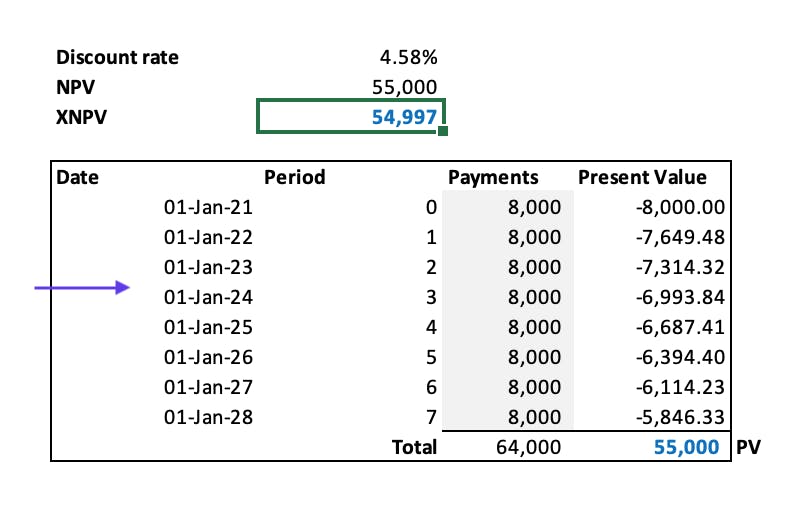

Present value is linear in the amount of payments. At commencement of the lease term finance leases should be recorded as an asset and a liability at the lower of the fair value of the asset and the present value of the minimum lease payments discounted at the interest rate implicit in the lease if practicable or else at the entitys incremental borrowing rate IAS 1720. The formula for calculating the present value of an ordinary annuity is.

Under the new lease accounting standards lessees are required to calculate the present value of any future lease payments. In summary no forecasting of future unknown lease payments will take place and in the United States contingent rents tied to either revenueusage or rates. Example 1 also includes a CPI increase.

Lets say you pay 1000 a month in rent. This increases the lease liability by CU2714. Our monthly rate is 025 and the present value of all monthly lease payments over 5 years is CU 55 708.

This method takes a future payment and uses discounting to determine the future payments present value. The fourth condition requires capitalization if the present value of minimum lease payments MLP is greater than 90 of the fair value of the asset. Note that this present value method assumes compounding interest annually.

The lease term covers the major part which is 75 or more of the remaining economic life of the asset being leased. In a leveraged lease the lending company holds the title to the leased. Present value of a single sum.

Where is the number of terms and is the per period interest rate. It also creates a corresponding Lease Liability based on the same calculation. The present value of the lease payments does not exceed 90 of the fair market value of.

Lets say your monthly rent is 1000. Present value commonly referred to as PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a specified period of time.

Excel Formula Future Value Vs Present Value Exceljet

Present Value Factor Formula Calculator Excel Template

Present Value Factor Formula Calculator Excel Template

How To Calculate Net Present Value Npv In Excel Youtube

Compute The Present Value Of Minimum Future Lease Payments Youtube

What Is The 90 Threshold For Net Present Value For Determining Whether A Lease Is Finance Or Operating Universal Cpa Review

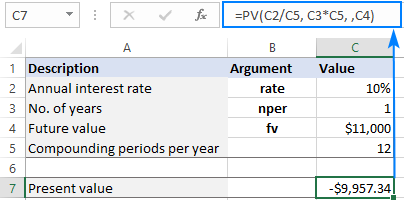

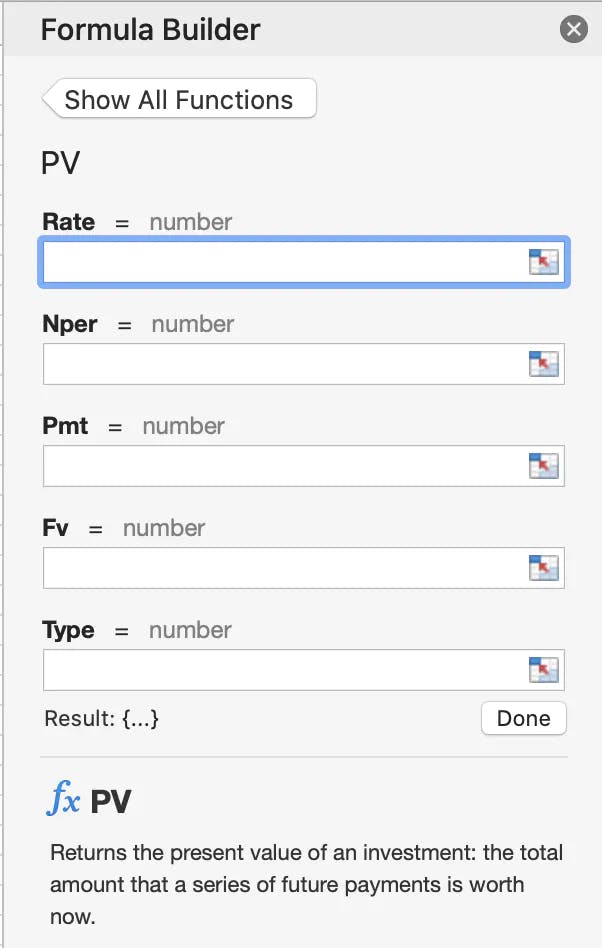

Using Pv Function In Excel To Calculate Present Value

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Discount Rate Implicit In The Lease

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Lease Payments In Excel

Present Value Formula And Pv Calculator In Excel

How To Calculate The Present Value Of Future Lease Payments

/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel

How To Calculate The Present Value Of Lease Payments In Excel

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

How To Calculate The Present Value Of Future Lease Payments