Buying a house with horrible credit

Another terrific way to improve your credit score is to make on-time payments to your creditors. However the borrower needs a 10 down payment.

How To Buy A House With Bad Credit A Guide For First Time Home Buyers

Pre-approval can help you save time and narrow your search as.

. These are mortgages insured by the Federal. The property market has been highly. Under FHA Guidelines home buyers can qualify for an FHA Loan with credit scores under 580 FICO.

Mortgage options if your spouse has bad credit. The caveat with these types of loans is that while they are insured by the government and can set. Buying a home is integral to the American Dream but it is increasingly out of reach for many hard-working adults.

Buying a house when one spouse has bad credit is still possible with the right mortgage. Like any other mortgage you can get pre-approved for an FHA loan. Good credit score 670-739.

Most conventional lenders require a credit score of at least 620 to qualify for a mortgage. How to buy a house with bad credit. Adjustable rate mortgage ARM Above 600.

Buying a House with Bad Credit. The lender will want you to pay off any outstanding collections and judgments. Try To Get Pre-approved.

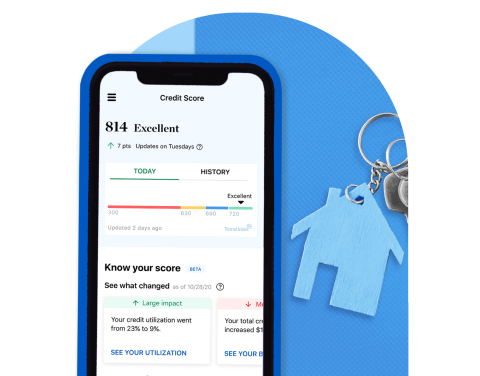

21 hours agoStep Six. However you may still be able to get a loan with a credit score of at least 500. There are five categories for credit scores as shown below.

If you determine that you can afford a house up to 300000 but your credit. 7 min ago. Mortgage lenders work with almost every credit score range.

Pre-approval can help you save time and narrow your search as. Here are your options and the steps you need to take to finally have your own home. The credit score needed to buy a house depends on the type of loan.

Typically the minimum credit score requirement for buying a house is between 500-620 depending on the type of loan. Heres a look at the steps to purchasing a house with bad credit. Some mortgage options cater.

Pay your bills on time every time. FHA loans let you put down as little as 35 if you have a credit score of 580 or higher. If you have a credit score of at least 580 then you can qualify for an FHA loan which is a loan with a lot of flexibility its not restricted to first-time homebuyers for example.

Traditional fixed-rate home loan. Best For an Easy Online Process. Like any other mortgage you can get pre-approved for an FHA loan.

With a credit score from 500 to 579 youll need a down payment of at least 10 for an FHA loan. Credit scores begin at 300 but 580 or higher is typically required for an FHA loan. FHA loans may allow lower credit scores in the 500.

If you have a credit score of 500-579 you must put. These loans can approve a borrower with a credit score as low as 500. A competitive market doesnt mean its impossible to own a home even if you have bad credit.

Very Good 740-799. In as few as 30 days youll start to see. Try To Get Pre-approved.

Rocket Mortgage is a name you probably know its Americas largest mortgage lender. The easiest way to improve your DTI is by shopping for homes at the lower end of your budget.

8 Home Remodeling Projects With Top Dollar Returns Home Improvement Loans Home Improvement Home Remodeling

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Buy A House With Bad Credit Nerdwallet

How To Get A Bad Credit Home Loan Lendingtree

Finding Home Loans With Bad Credit Yes You Can

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Buy A House With Bad Credit American Financing

Tonystip For Today In 2022 Selling House Real Estate Estates

When Is Foreclosure Right For You

Can You Get A Bad Credit Home Loan Credit Karma

Do You Own A Property Interested In Renting We Ll Vet Prospective Tenants By Carrying Out Credit Che Home Loans Mortgage Loan Originator Mortgage Banking

How To Buy A House With Bad Credit In 2022 Tips And Tricks

Helping Broward County Homeowners Shorts Sale Avoid Foreclosure Broward

How To Buy A House With Bad Credit Nerdwallet

A Single Man S Guide To Buying A House Elmens Loan Consolidation Debt Consolidation Loans Bad Credit

Foreclosure Versus Short Sale There Are Significant Differences Between Foreclosures And Short Sales Buy Selling House Selling Real Estate Real Estate Tips

Avid House Buyers We Buy Houses Home Buying House